22 October 2025

2503

18 min

5.00

Sales Season 2024 in Numbers: What Retailers Should Keep in Mind for 2025

Content

Black Friday (BF) is the annual sales phenomenon when eager shoppers rush to buy, and brands compete for their attention with the most attractive deals. To help you shape your strategy and make the most of Black Friday and Cyber Monday (CM) 2025, we’ve gathered the key stats and insights from last year’s holiday season.

The Yespo CDP team analyzed consumer spending patterns and marketing activities based on 2 billion messages sent from the platform during Black Friday week.

TL;DR—10 Key Insights

- During the BF week, the share of “New Users” rises sharply: +97% a week before, +141% on BF, +156% on CM.

- “Returning Users” peak on Wednesday before BF (+43%) and on BF itself (+30%).

- Average Order Value (AOV) grows by +18% on BF and +50% on CM.

- Mobile share usually sits at ~75%, drops to 72% on BF, and rebounds to 79% between BF and CM.

- Top-performing categories:

- Fashion & Accessories: +169% (BF)

- Kids & Toys: +174% (Wednesday after BF)

- Books: +81% (BF); Pets: +72% (BF)

- Electronics / Marketplaces / Home & Garden show steady growth:

- Electronics: +60% (Wed before BF), +36% (BF), +40% (CM)

- Marketplaces: +48% (Wed before BF), +38% (BF)

- Home & Garden: +42% (BF)

- Channel breakdown: Email 52%, Mobile Push 22%, App Inbox 14%, Web Push 10%, Viber 2%, SMS 0.3%.

- Conversion Rate (CR) by channel:

- In-App 7,67%

- Viber 6,24%

- Telegram-bot 3,36%

- Email 2,78%

- App Inbox 1,64%

- Popups (widgets) 1,41%

- Mobile push 0,95%

- Web push 0,31%

- Conversion rates spiked across all tiers in 2023, then stabilized in 2024.

- Median traffic from 1,000 contacts: Email 53, Viber 94, Web Push 49, Mobile Push 98—with notable seasonal uplift.

How Long Does the Sale Season Really Last?

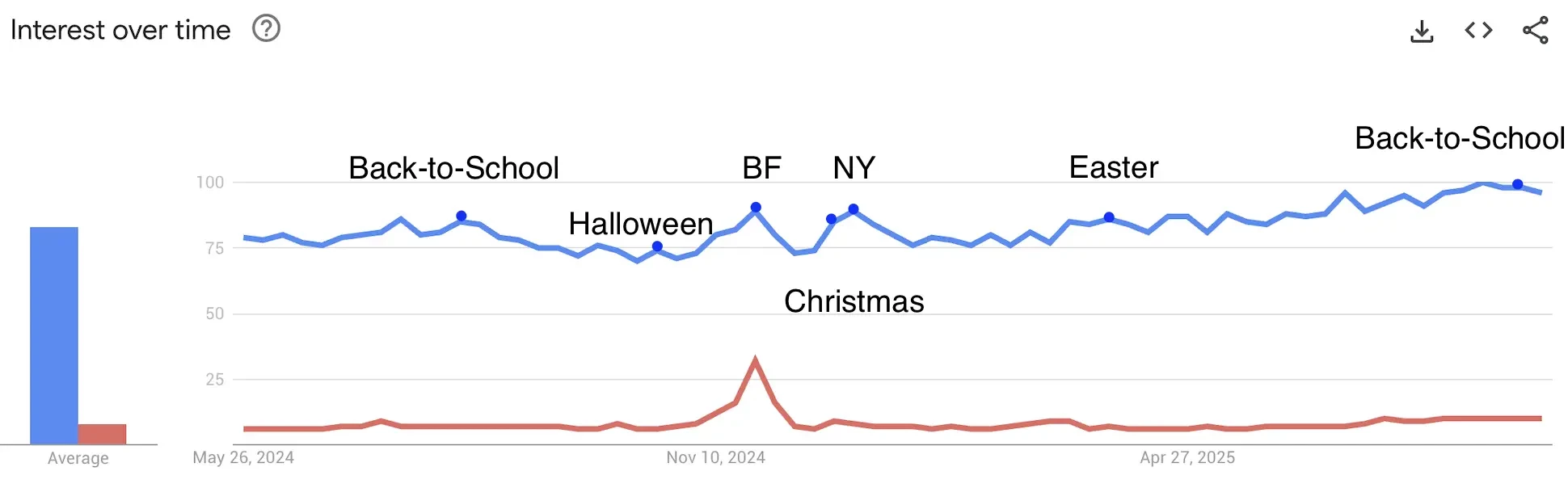

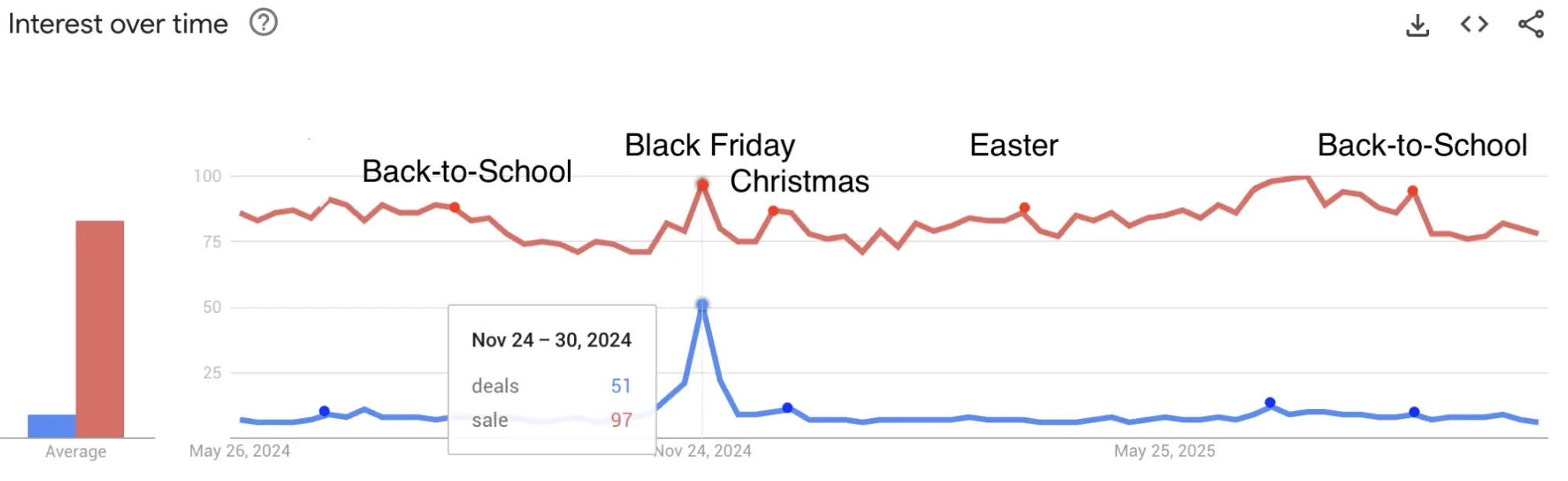

The most popular shopping events, of course, are Black Friday (November 28, 2025) and Cyber Monday (December 1, 2025). However, the first wave of discounts—and data collection that later fuels personalization—starts as early as September, during Back-to-School campaigns and Halloween promotions.

It’s also worth noting the next major sales peaks that occur after Christmas and up until Easter in April.

According to our social media survey:

- 50% of businesses plan to run Christmas promotions;

- 38% will extend discounts until Easter.

Do you leverage such marketing occasions in your campaigns?

How We Collected This Data

The numbers in this article are based on Yespo client research, combining company performance metrics with customer behavior analysis.

|

Period |

Black Fridays 2021–2025 (focus on peak weeks) |

|

Sample |

Nearly 900 online stores, retailers, and marketplaces using the Yespo CDP |

|

Volume |

Over 2 billion messages sent across various channels |

|

Goal |

Track changes in buyer behavior and channel performance to plan 2025 campaigns |

|

Conversion Definition |

A purchase made after interacting with a message (email, push, bot, widget, etc.) or clicking a recommendation block |

|

Industry Breakdown |

25% Fashion & Accessories 22% Home & Garden 16% Pharmacies & Health 9% Electronics 9% Food & Beverages 5% Automotive 4% Marketplaces 4% Books 3% Kids & Toys 2% Pets 1% Sports & Hobbies |

Key Terms We Use

The following core metrics help identify how many users visit your website or mobile app:

- New Users—people who interacted with your website/app for the first time during the selected period.

- Returning Users—those who previously interacted with your website/app and came back within the selected period.

CR (Conversion Rate)—the share of users who made a purchase after engaging with a message (email, push, bot, widget, etc.).

AOV (Average Order Value)—the average purchase amount per completed order over a given period.

How the Behavior of Yespo Clients Has Changed

Key achievements during Black Friday 2024:

- +28% increase in messages sent on Black Friday compared to the previous year.

- 200 million attributed sales were generated by clients using Yespo on that day.

- 309,464 attributed purchases were completed on Black Friday.

- +28.52% growth in revenue compared to 2023.

- 71% of sales came from Email, followed by Mobile Push (15%) and Web Push (8%).

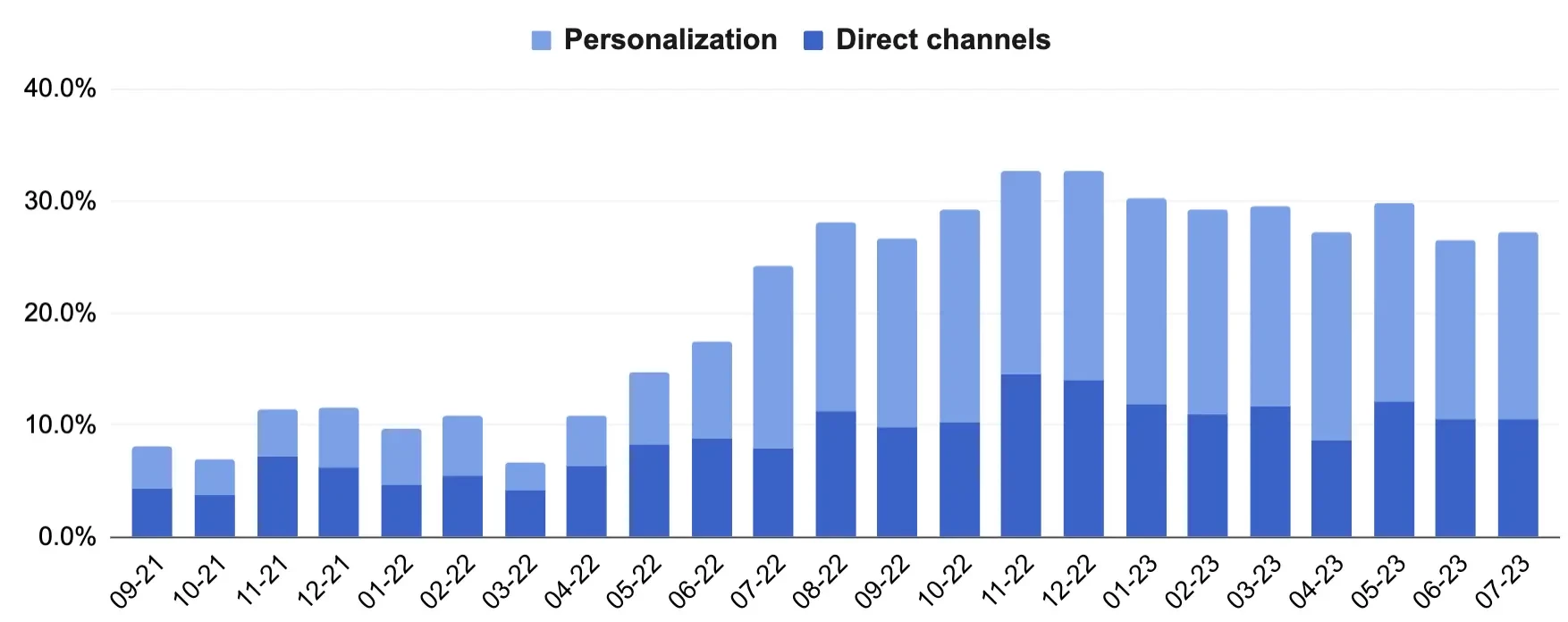

Channel Preferences

Message distribution by volume:

- Email—52% (+20% YoY). The most scalable and cost-efficient channel with low contact costs on large databases, flexible personalization (product recommendations, segmentation), high deliverability, and predictable performance during peak days.

- Mobile Push—22% (+45% YoY). The growth is driven by more brands launching mobile apps and integrating them into their communication strategies.

- App Inbox—14% (+16% YoY). “Silent” in-app messages (bell icon) that don’t interrupt the user journey. They’re shown to logged-in users at the right moment (triggered by event or segment), have high CTR, and amplify other channels without extra delivery costs.

- Web Push—10% (+67% YoY). A fast and low-cost remarketing channel that reaches users directly in the browser—even when the site tab is closed. It doesn’t require double opt-in like email, making it a great addition for increasing reach. The growth is linked to more behavioral triggers (“price drop,” “back-to-stock,” “abandoned view”) and seasonal traffic spikes around Black Friday/Cyber Monday.

- Messenger—2% (+68% YoY) and SMS—0.3% (+9% YoY). Niche but tactically important mobile channels. Though their share is small, they grow annually, helping reinforce mobile communication and boost campaign performance.

Want to boost your sales during the peak season? We’ll show you how to make it happen in your channels.

How AI Recommendations Became a Growth Driver in 2024–2025

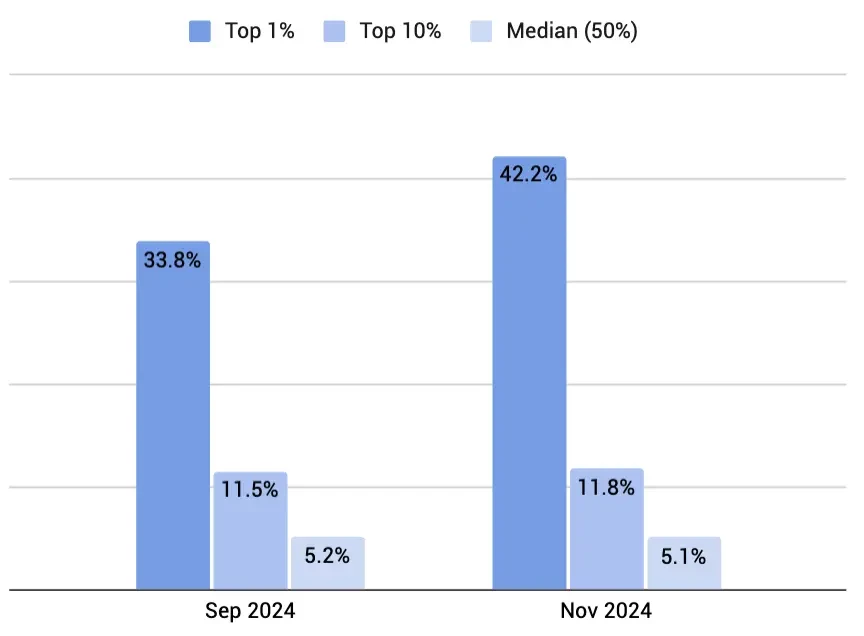

Over the past two years, we’ve seen a systemic shift—the share of sales generated by personalized AI recommendations has been steadily growing among leading companies. This reflects the broader personalization trend and highlights its importance, especially during discount-heavy periods when every brand competes for attention.

When each contact receives relevant products and offers, key performance metrics such as CTR, CR, and AOV all increase—particularly on days of peak demand.

- Top-1%: 33.8% → 42.2%

- Top-10%: 11.5% → 11.8%

- Median (50%): 5.2% → 5.1%

To join the top 10%, focus on three key areas:

- Implement product recommendations across all channels.

- Add recommendation blocks even to promotional campaigns, not only to automated triggers.

- Personalize every page of your website—homepage, category pages, even error pages (404).

Learn more about Yespo’s AI-powered features >>

How Buyer Behavior Has Changed

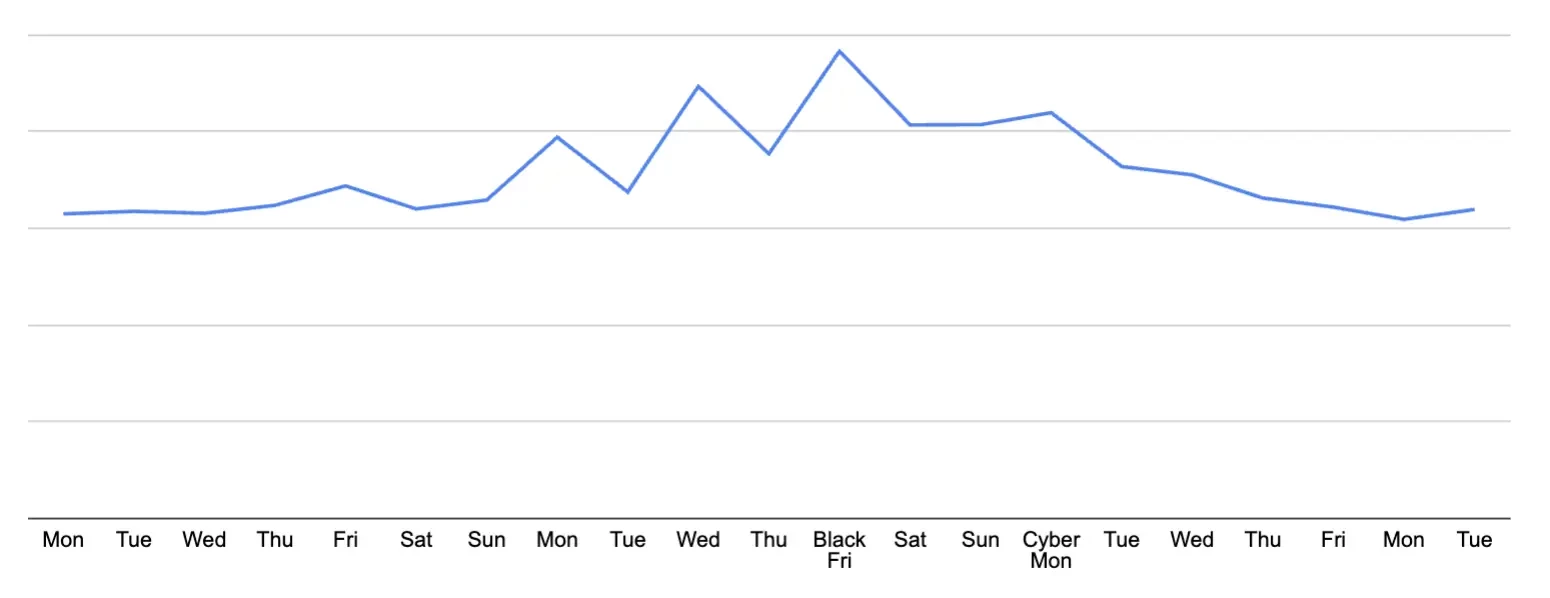

Sales activity starts building a full week before Black Friday:

- Friday (T–7): +6% vs. the previous week’s average

- Monday: +21%

- Wednesday: +38%

- Peak on Black Friday: +49%

- Cyber Monday: +21%, followed by a gradual decline

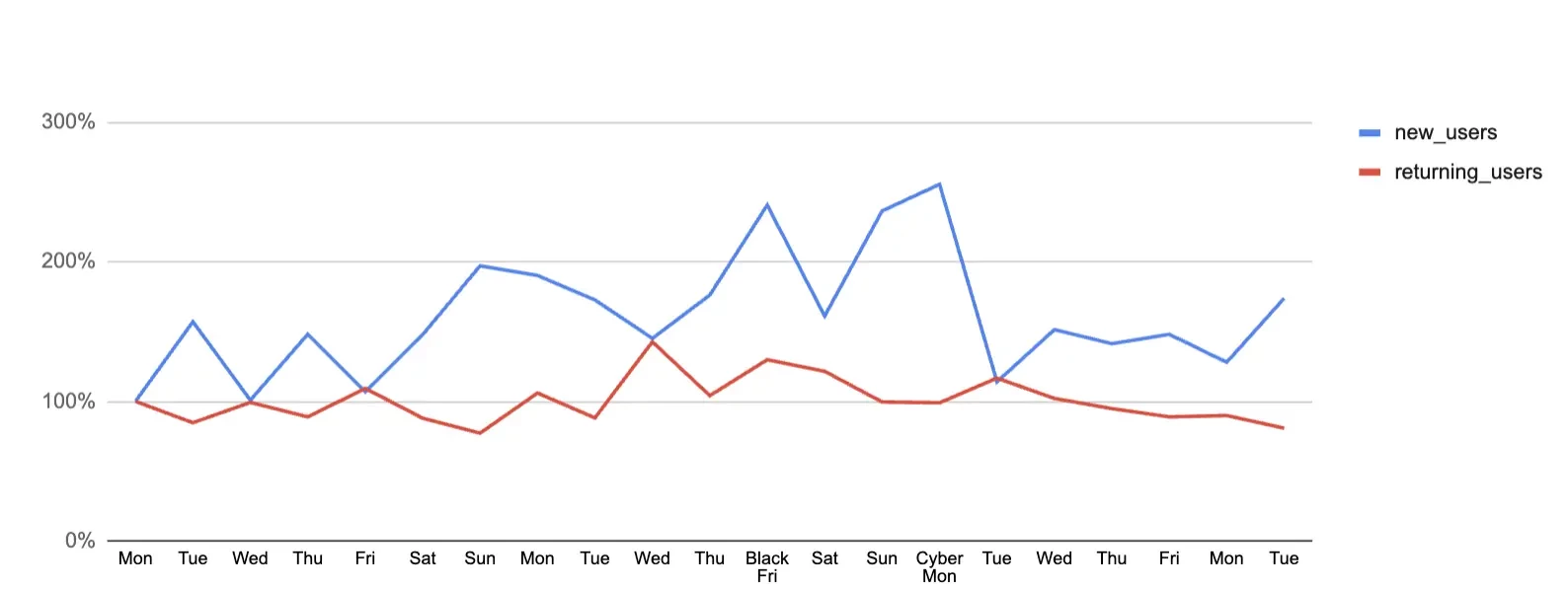

Audience behavior shifts even before the main event. Starting from T–7, traffic begins to warm up, with a surge of new leads and repeat purchases on Black Friday and Cyber Monday. These are the prime days for audience growth and lead conversion into repeat buyers.

- “New users”: +97% (T–7), +141% (Black Friday), +156% (Cyber Monday)

- “Returning users”: +43% (Wednesday before BF), +30% (Black Friday)

Insight:

These are the best days to scale your lead acquisition—afterward, focus on conversion and LTV growth. To capture this traffic effectively, use pop-ups (widgets) to collect data and preferences, or redirect users to quick-subscription channels like Messengers or Web Push.

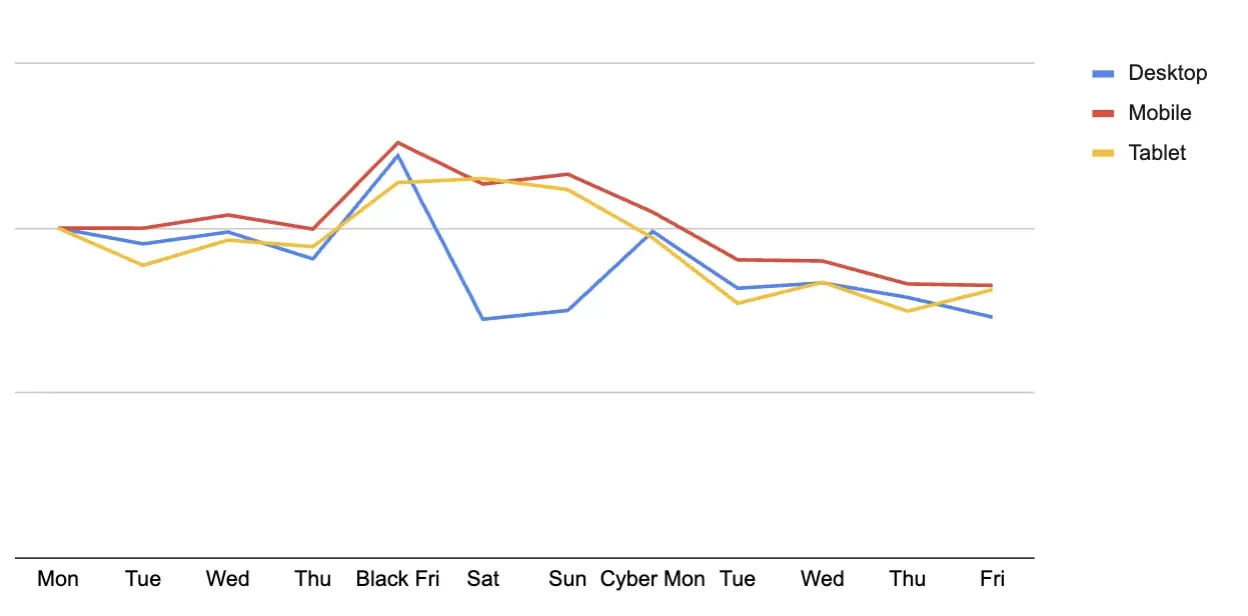

The majority of purchases come from smartphones (around 75%). On Black Friday, mobile share slightly drops to ~72% due to higher desktop activity, then climbs back to ~79% between Black Friday and Cyber Monday.

These numbers once again highlight the importance of responsive content: every promotional message should be tested across both desktop and mobile. A poor user experience on your website or app can easily become a deal-breaker.

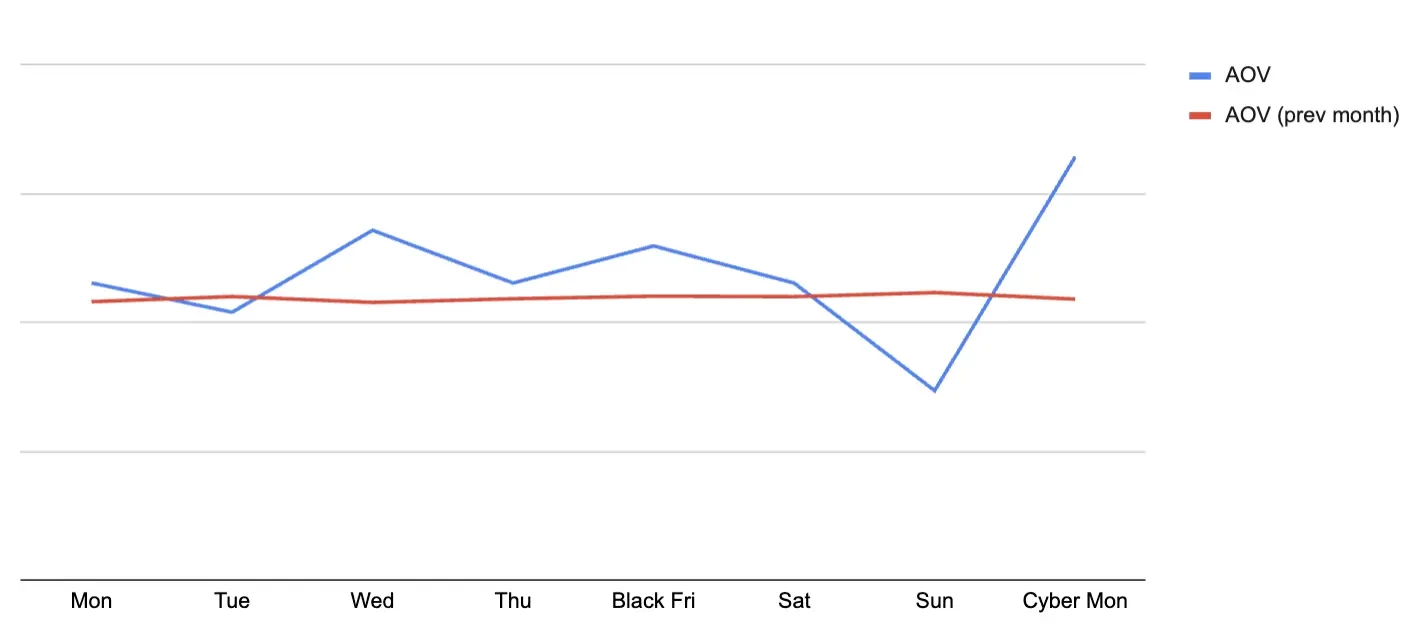

During the Black Friday period, AOV increases by an average of 18%, and on Cyber Monday by 50%. On Black Friday, the uplift is especially strong on mobile devices (+48%), compared to +29% on desktop, while on Cyber Monday, the growth levels out across both platforms.

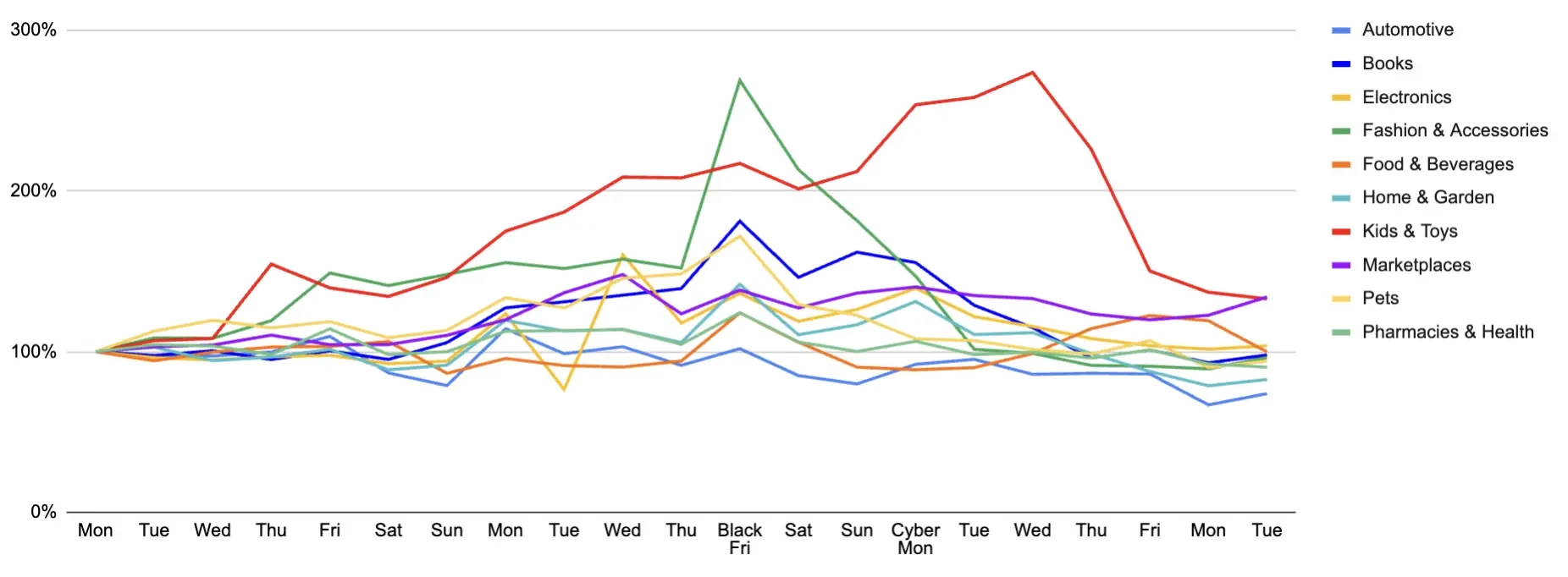

Demand Dynamics by Industry

Industries with longer decision-making cycles—such as automotive—show smoother sales curves without sharp spikes, reflecting the extended purchase consideration period.

Steady growth:

- Electronics: +60% (Wed before BF) → +36% (BF) → +40% (CM)

- Marketplaces: +48% (Wed before BF) → +38% (BF)

- Home & Garden: +42% (BF)

Most dynamic categories

- Fashion & Accessories: peak +169% (BF)

- Kids & Toys: gradual uplift starting a week earlier, peak +174% (Wed after BF)

- Books: +81% (BF)

- Pets: +72% (BF)

Share of purchases from new vs. returning users on black friday (by industry):

- Home & Garden—81%

- Food & Beverages—65%

- Books—64%

- Pets—46%

- Fashion & Accessories—37%

- Pharmacies & Health—37%

- Marketplaces—37%

- Kids & Toys—33%

- Automotive—25%

- Electronics—11%

On Cyber Monday, the share of new buyers rises significantly in several categories:

- Fashion & Accessories—82%

- Kids & Toys—44%

- Marketplaces—50%

…and decreases in others:

- Food & Beverages—21%

- Books—38%

- Automotive—8%

Insight:

Impulse-driven categories attract more new buyers on Cyber Monday, when users return for postponed purchases. In everyday-demand segments, the share of new buyers declines—early scarcity and quick decisions dominate on Black Friday. To recapture delayed intent and maximize profit on Cyber Monday, activate your most effective triggers—viewed item, abandoned cart, price drop, and back-in-stock—not only via Email, but also through Web Push, Mobile Push, and bots.

Biggest AOV increases on Black Friday:

- Food & Beverages: mobile ×2.8, desktop ×2.3

- Books: mobile ×1.9, desktop ×2.05

- Fashion & Accessories: +38% (mobile), +14% (desktop)

- Automotive: +45% (desktop), minor changes on mobile

Categories such as Electronics, Marketplaces, and Pets show moderate AOV growth, while most other segments see a slight decline.

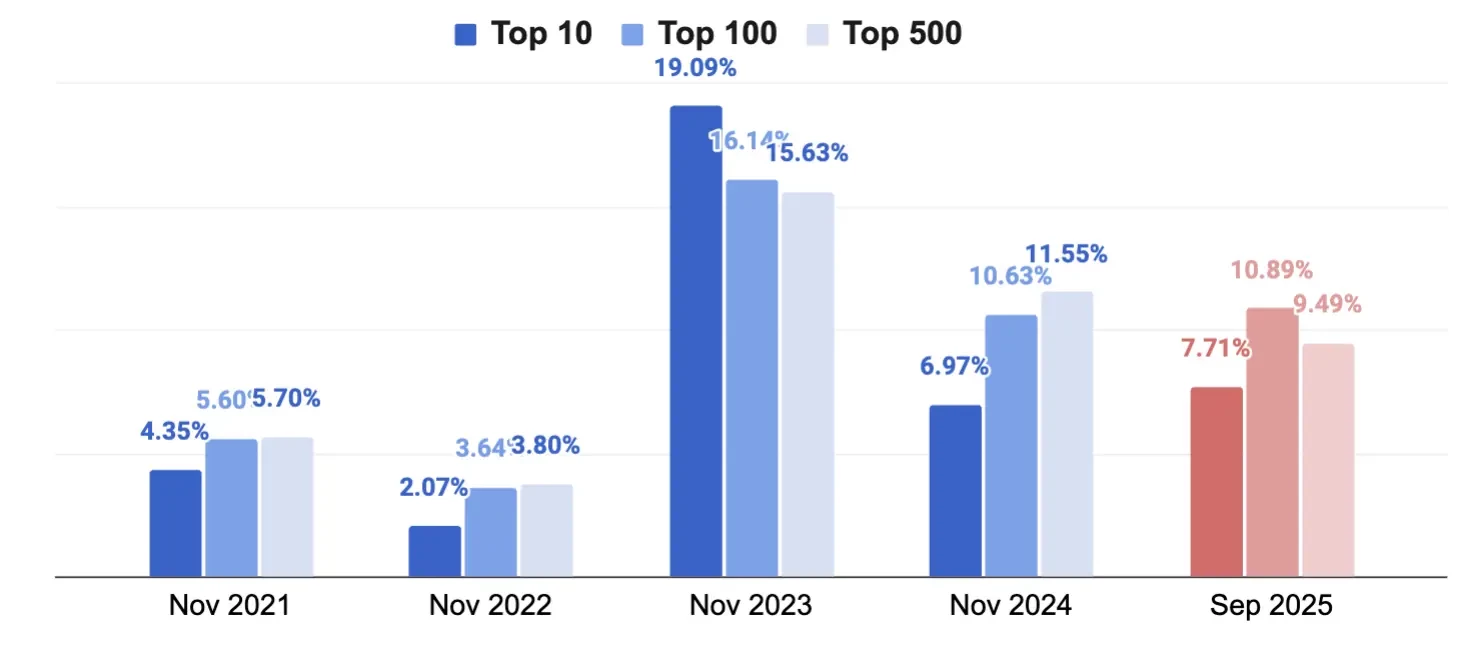

Conversion Rate 2021–2024: Top-10 / Top-100 / Top-500

These three tiers represent companies sorted by traffic volume (clicks) during the Black Friday period. Each group includes, respectively, the 10, 100, or 500 brands with the highest click counts.

Year-over-year comparison (November):

- Top-10: 2021 4,35% → 2022 2,07% → 2023 19,09% → 2024 6,97%

- Top-100: 2021 5,60% → 2022 3,64% → 2023 16,14% → 2024 10,63%

- Top-500: 2021 5,70% → 2022 3,80% → 2023 15,63% → 2024 11,55%

In 2023, we saw a sharp uplift—driven by higher traffic quality and stronger personalization—followed by stabilization in 2024 at a level still well above 2021.

For 2025, we expect conversion growth among top players, as results from August 2025 show:

- Top-10: +11%

- Top-100: +3%

- Top-500: –18% (likely due to seasonal inactivity)

Insight:

The Top-10 grow thanks to consistent investment in first-party data collection and personalization, while the Top-500 struggle due to lower communication frequency and limited flexibility in budgets. In many niche industries, budgets are preallocated and rigid, making it difficult to reallocate spend between channels, raise bids, or launch additional creatives during peak periods.

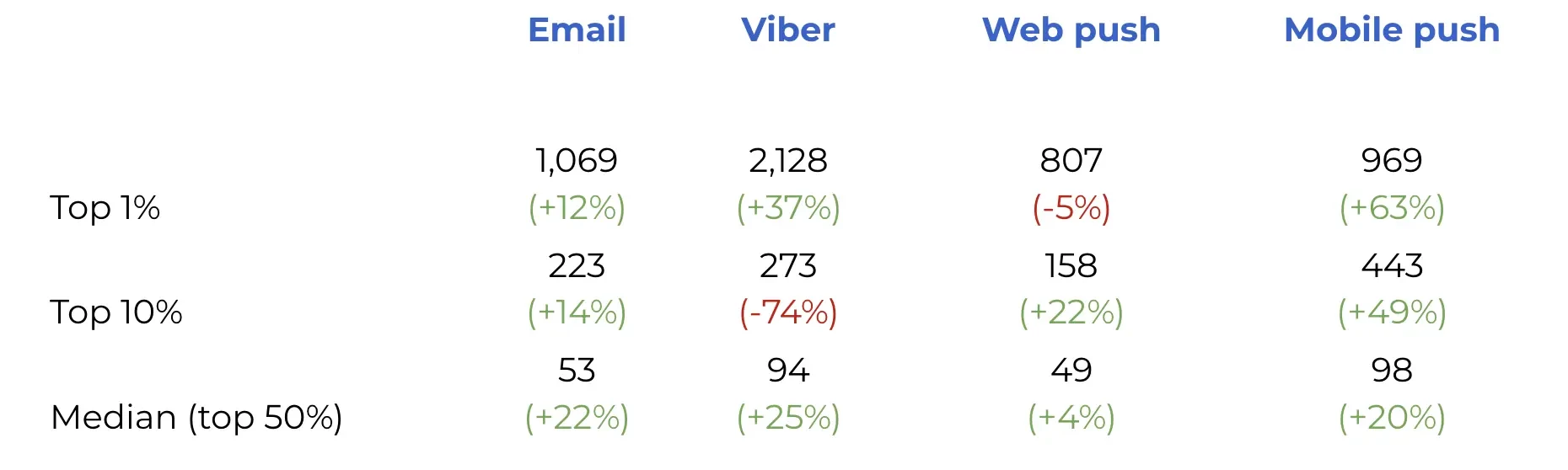

Channels 2025: Traffic, CTR, and ROI Benchmarks

Below are benchmarks for clicks per 1,000 contacts as of August 2025. We highlight three performance tiers—Top 1%, Top 10%, and Median (market norm)—since channels behave differently during peak seasons. This approach helps you see both best practices (Top 1%) and realistic expectations (Median), offering an understanding of the potential ceiling and the average achievable result.

- Top 1% (maximum performers):

- Email 1069, Viber 2128, Web push 807, Mobile push 443

- Top 10% (ambitious but realistic):

- Email 223, Viber 273, Web push 158, Mobile push 969

- Median (market norm):

- Email 53, Viber 94, Web push 49, Mobile push 98

Seasonal Growth vs. Off-Season

- Top-1%: Email +12%, Viber +37%, Mobile push +63%

- Top-10%: Email +14%, Web push +22%, Mobile push +49%

- Median: Email +22%, Viber +25%, Web push +4%, Mobile push +20%

What does this mean?

For example, if your email median = 53 per 1,000 contacts, a company with a database of 100,000 contacts can expect approximately 53,000 visits to the website or app.

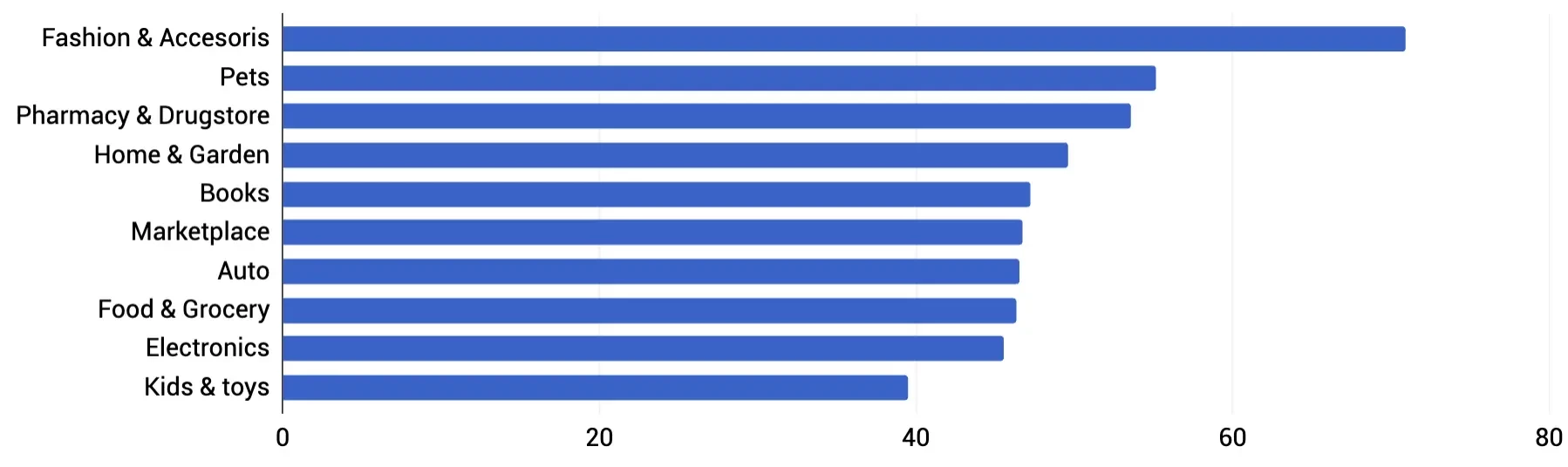

Email channel efficiency by industry (monthly median per 1,000 contacts):

- Leader: Fashion & Accessories—71

- Above average: Pets—55, Pharmacies & Health—54

- Lowest: Kids & Toys—40

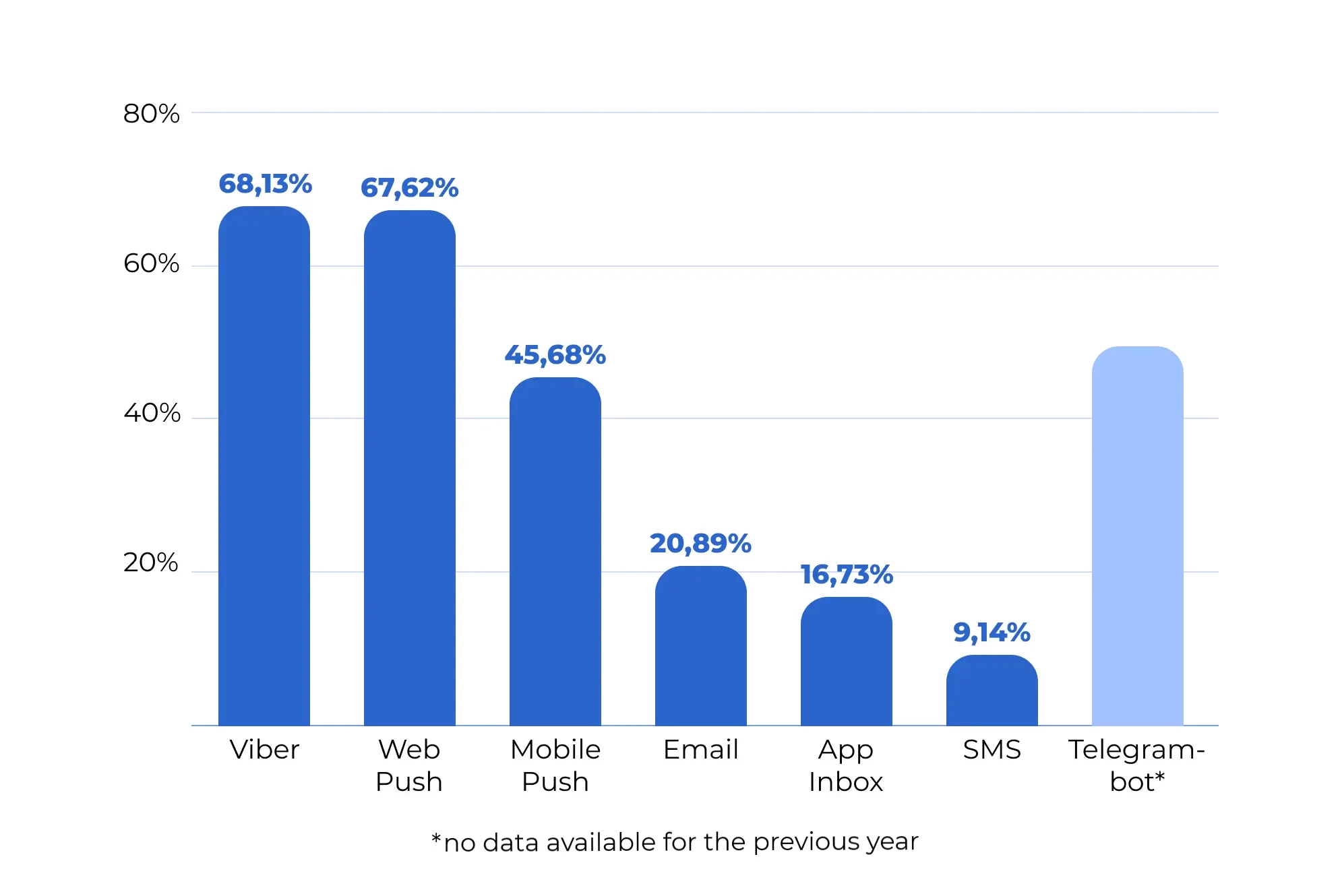

CTR shows how well your message content resonates with audience expectations in a specific channel and context. High CTRs for Widgets and In-App messages come from contextual relevance and timing of delivery.

- Popups (widgets)—20,67%

- In-App—20,05%

- Viber—3,25%

- Telegram-bot—2,21%

- Mobile push—1,88%

- App Inbox—0,62%

- Email—0,55%

- Web push—0,50%

CR (Conversion Rate) after click—this metric is the ultimate test of traffic quality per channel.

The leaders—In-App and Viber—succeed for different reasons: the former benefits from warm, engaged app sessions, while the latter performs well thanks to fast promotional delivery to loyal audiences.

- In-App—7,67%

- Viber—6,24%

- Telegram-bot—3,36%

- Email—2,78%

- App Inbox—1,64%

- Popups (widgets)—1,41%

- Mobile push—0,95%

- Web push—0,31%

|

Channel |

Probable Conversion per Send, % |

Cost per Order (EUR) |

Break-Even AOV (30% Margin, EUR) |

Break-Even AOV (50% Margin, EUR) |

Orders (Base 50K) |

|

In-App |

1.54 |

0.06 |

0.20 |

0.12 |

768 |

|

Widget |

0.29 |

0.32 |

1.08 |

0.65 |

145 |

|

Telegram Bot |

0.07 |

1 |

4.22 |

2.53 |

37 |

|

App Inbox |

0.01 |

9 |

30.82 |

18.49 |

5 |

|

Mobile Push |

0.01 |

11 |

35.46 |

21.28 |

9 |

|

|

0.02 |

18 |

59.30 |

35.58 |

8 |

|

Viber |

0.20 |

20 |

65.75 |

39.45 |

101 |

|

Web Push |

0.002 |

116 |

387.10 |

232.25 |

1 |

Insight:

From a CPO (Cost per Order) and AOV standpoint, In-App and Widgets perform best for direct sales. Email and Viber are key for scaling reach and revenue, but require precise targeting. Web Push should be reserved for niche remarketing scenarios with highly specific triggers.

What to Do in 2025 to Achieve the Best Results

To make the most of the season—with both quick wins and long-term strategies—here’s a step-by-step action plan. It helps you execute immediate improvements while laying the foundation for the next quarter.

- Personalization: Add AI-powered recommendation blocks not only to triggered campaigns but also to mass email sends and other channels.

- Additional touchpoints: Use App Inbox, In-App messages, Telegram bots, and segmented widgets to increase engagement.

- Smart budgeting: Build predictive segments to use costly channels like Viber and SMS more efficiently—targeting audiences with a high purchase probability, while using email/push for the rest.

- Gamification in widgets and bots (wheel of fortune, scratch cards, gifts, slot machines)—for lead generation and conversion boosts during peak days.

- Mobile optimization: Ensure smooth, adaptive interactions across all mobile touchpoints.

- AI automation: Use AI-generated campaigns and messages to reduce content production time.

- Run multi-variant A/B tests with auto-winner selection to send only the top-performing version to your full audience.

Conclusions

Black Friday isn’t just about record-breaking revenue days—it’s also about expanding your database and playing the long-term LTV game. The channels with the highest share of sends—Email and Mobile/App—perform best when used in an omnichannel strategy. Personalization, predictive modeling, and AI are no longer “nice-to-haves”—they’re the minimum requirement to compete for customer attention during peak season.

Ready to find out where your business is losing conversions?

Our team of experts will conduct a quick Black Friday workflows audit and build a growth plan for the next 2–3 weeks.