06 December 2025

465

7 min

5.00

Black Friday 2025 Report: +33% Revenue, Shifts in Consumer Behavior, and Channel Performance. A collaborative report by Yespo and Promodo

The biggest sale of the year is finally behind us, and it’s time to draw conclusions and think about improving strategies for 2026. We analyzed the behavior of online retailers during Black Friday week 2025 and throughout the entire month of November, so you can gain a comprehensive understanding of customer behavior and channel performance.

The sample includes 946 online stores and retailers. Partner data from Promodo complemented the picture, highlighting trends in demand, traffic, and acquisition channels – including the role of branded direct traffic during peak days.

What Defined Black Friday 2025

On the main sale day, 121 million messages were sent – a 29% increase compared to the previous year. The overall message volume for the month increased by 11%, reflecting stronger competition for customer attention and indicating that in 2025, brands actively expanded their contact databases.

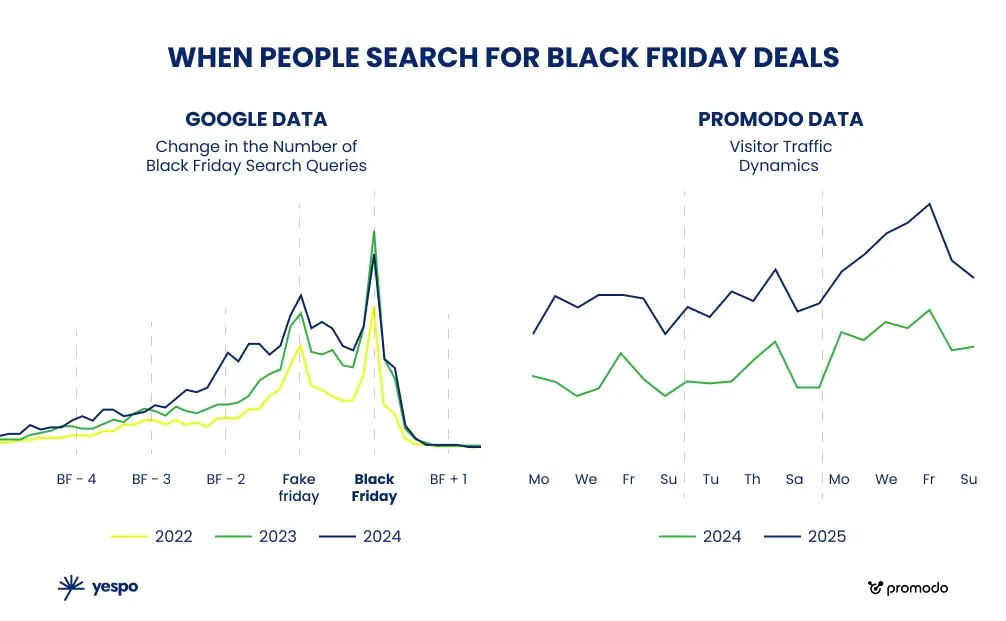

However, to draw more representative conclusions, it’s important to analyze the entire week rather than just a single day. Many brands start warming up their audiences in advance and offer early access to discounts for their subscribers.

Traffic

During Black Friday week, traffic grew by 42%. The traditional peak sales days were Friday itself and the preceding Monday. Throughout the promotional week, there were no visible drops in activity – the order curve stayed high from start to finish.

Demand began forming in advance: steady growth in orders was already recorded starting on November 21. Interestingly, the Sunday after Black Friday showed higher-than-expected demand.

Revenue, Orders, and Average Order Value

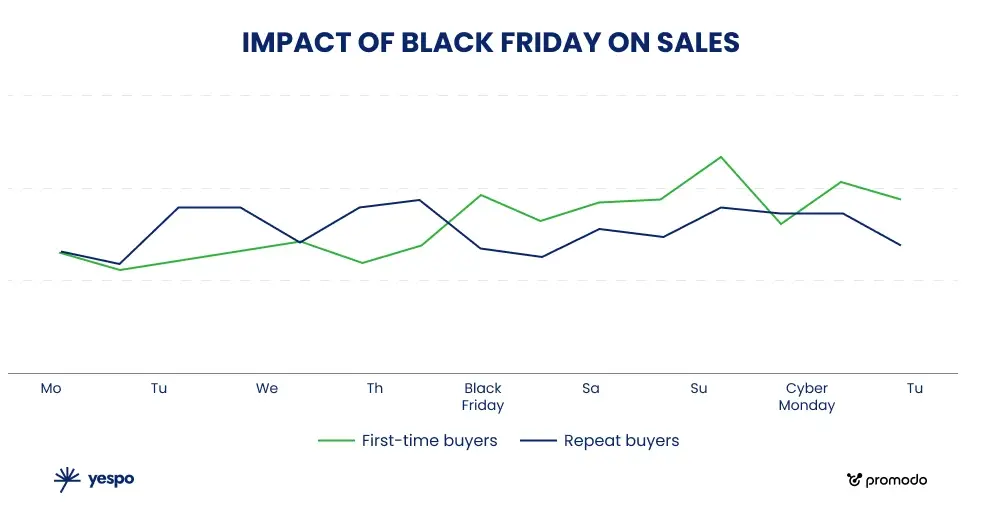

The metrics showed steady growth from Monday through Friday, with Black Friday marking the weekly peak – up +48% among new customers and +23% among returning ones.

The categories that attracted the most new buyers were:

- Pet Supplies – +76%,

- Fashion & Accessories – +56%,

- Home & Garden – +46%.

According to our data, during the Black Friday period, the average order value (AOV) increased by 7.6%, with a notable 11.8% growth on Friday and Saturday. Interestingly, unlike last year, Cyber Monday didn’t show an increase in AOV – shoppers tended to finalize previously postponed purchases rather than increase basket size.

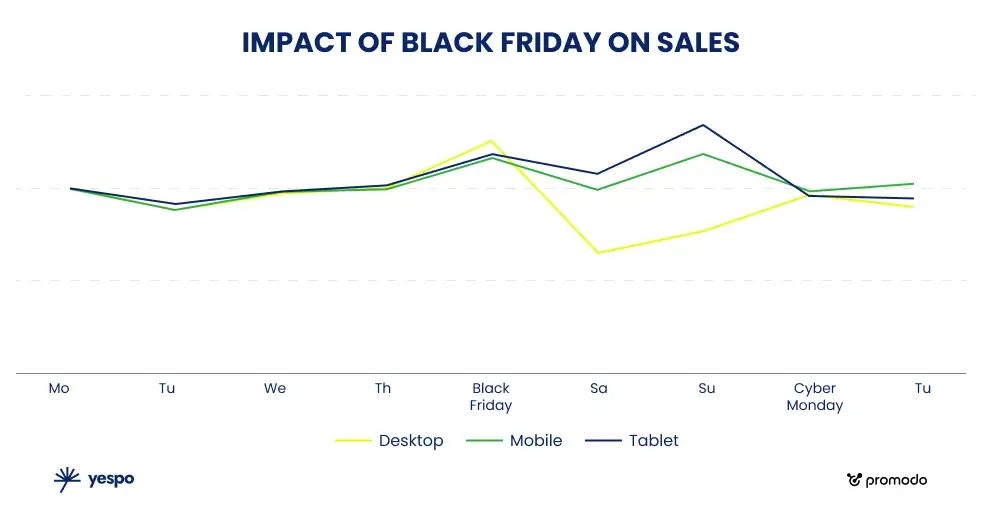

Compared to a non-seasonal week, AOV on desktop rose by +17% on Black Friday, while mobile increased by +10%. On Saturday, the situation reversed: mobile +20% vs desktop +8%. On Sunday, mobile growth remained at +10%, while desktop added +3%. Thus, desktop peaked on Friday, while mobile took the lead over the weekend.

According to partner data, online retailers earned +33% more revenue year-over-year in USD during Black Friday week 2025. This growth was driven mainly by a +25% increase in the number of orders. The average order value remained nearly unchanged, adding around +7% USD – meaning that customers bought more often, but not significantly more expensively.

Start preparing for the next sales season today! Get your free guide featuring audience analysis, channel selection, omnichannel strategies, and proven sales tactics.

Get the guideDevices

The share of transactions made via smartphones in November increased from 75% to 78% year-over-year. However, there was a slight temporary drop during the peak shopping days: 75% on Black Friday and 77% on Cyber Monday. Over the weekend, the share climbed back up to 83%.

Starting from Saturday, mobile devices (smartphones and tablets) became the main source of conversions. A likely explanation: on Friday, a significant share of purchases is made from work devices, while on weekends, users tend to shop more from their phones at home.

Categories and Seasonal Products

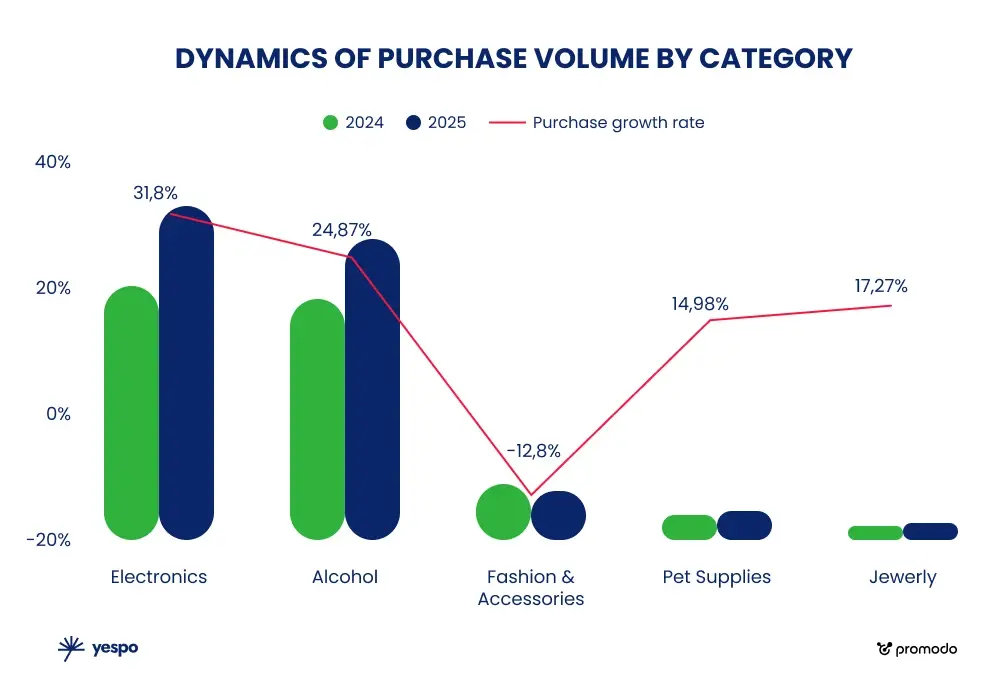

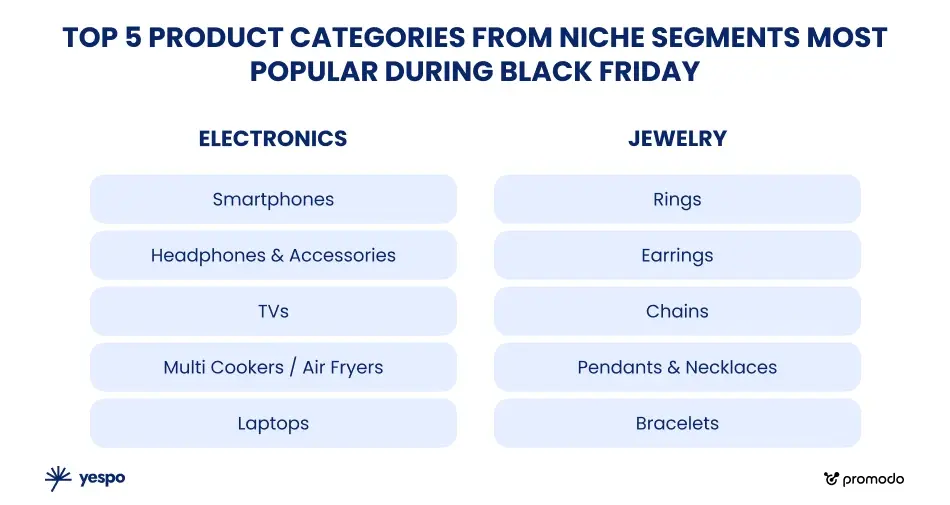

The highest revenue growth (in USD) was recorded in the following categories:

- Electronics – +37%,

- Jewelry – +32%,

- Food & Alcohol – +30%.

Pet supplies didn’t make the top three but still demonstrated a solid +25% revenue growth.

The top-performing product categories of the season remained largely unchanged: home appliances, gadgets, and jewelry. Demand for charging stations was consistently high from the very first days of the campaign.

In the pet supplies segment, cat food dominated by the number of orders – three times more than dog food – while the revenue gap between the two categories was about 10%.

Acquisition Channels and the Role of Brand

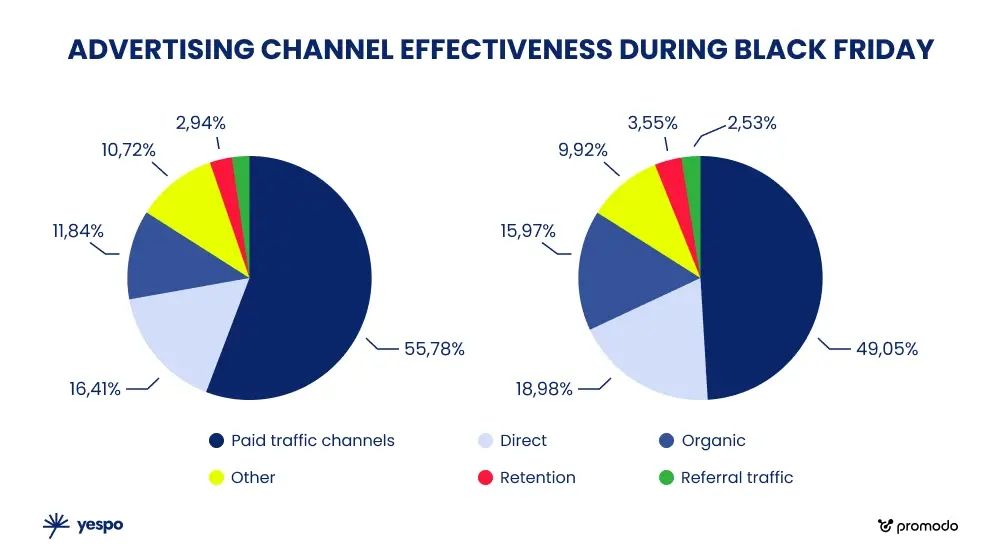

When examining traffic sources, paid channels proved to be the most effective in driving user acquisition. In terms of revenue distribution, paid channels also remained the top performer – however, their overall share decreased slightly, while Direct traffic grew, highlighting the increasing strength of brand recognition.

It’s also worth highlighting retention channels (email, Viber, App Inbox, Web Push, etc.), which together generated nearly 20% of total revenue on Black Friday itself.

Communication Channels

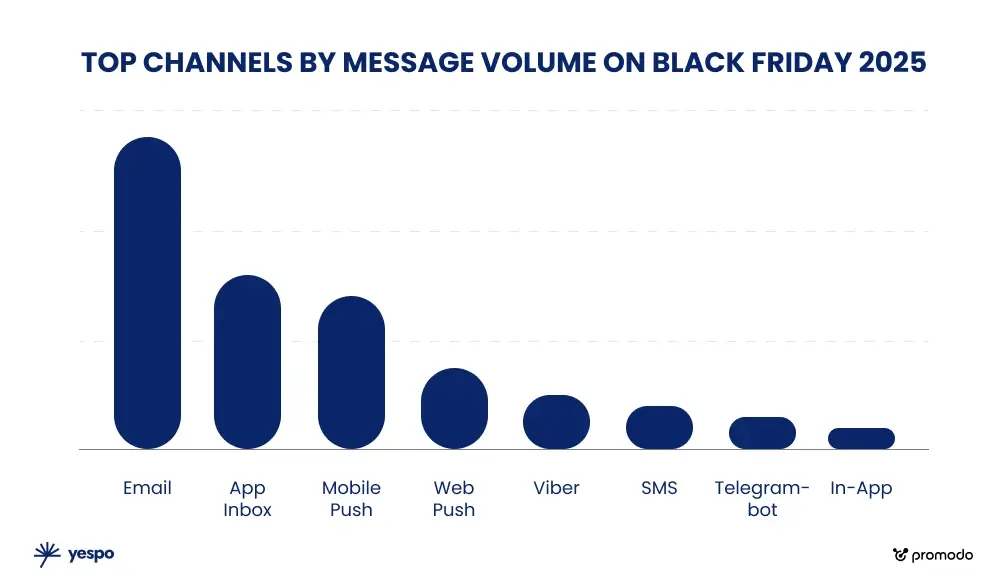

Top channels by message volume on Black Friday:

- Email – 57.21% on Black Friday, 52% for the entire November

- App Inbox – 18.17% on Black Friday, 15% for the month

- Mobile Push – 16.04% on Black Friday, 22% for the month

From a growth perspective, the highest year-over-year increases were shown by App Inbox and Telegram bots. Notably, around 10% of all SMS and Telegram bot messages in November were sent on Black Friday alone – three times more than on an average day. Viber also gained share, growing from 1.6% to 2.2%, confirming the trend that niche and tactical mobile channels continue to expand each year.

App Inbox and Telegram bots showed the most significant increase in usage in 2025. The share of SMS and Telegram bot sends on Black Friday reached 10% of all monthly volume, again, three times higher than usual.

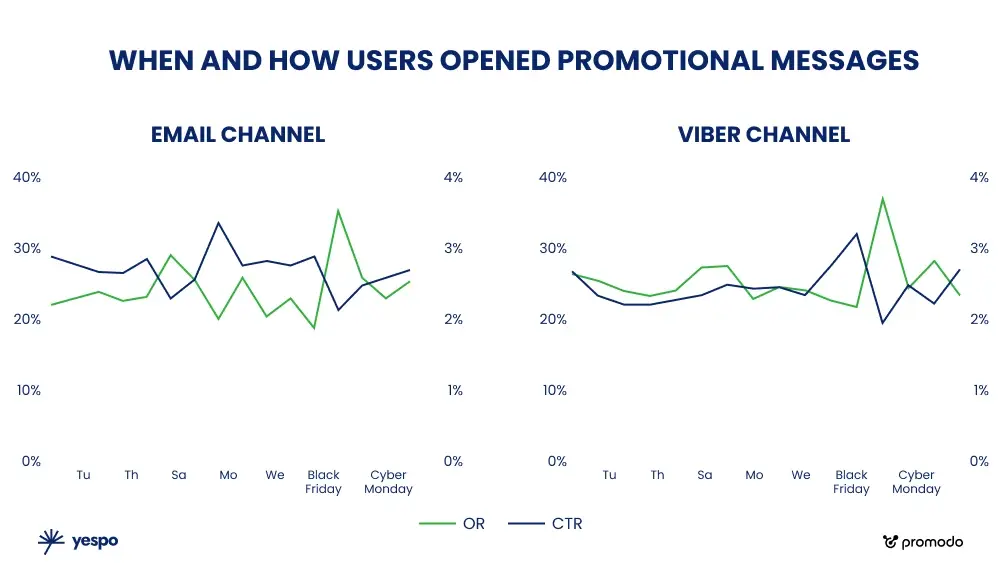

Email. Open rates tend to drop on Black Friday due to extreme inbox competition. On Saturday, the open rate (OR) peaks, while CTR declines; on Monday, the situation reverses, and CTR reaches its maximum.

Peak values: OR up to 35%, CTR 3.34%.

Viber. CTR peaks precisely on Black Friday, as short, time-sensitive offers perform best. Open rates, similar to email, shift to Saturday.

Peak values: OR up to 92%, CTR 6.4%.

So, buyer behavior and sales dynamics during Black Friday 2025 show that brands with an omnichannel approach win consistently. Individual channels peak on different days across the week, so coordinated use of email, messengers, push, and the app delivers maximum reach and steady growth without “troughs” between demand waves. At the same time, prioritizing mobile experience is critical – mobile interactions grow every year, and optimizing for smartphones lifts the effectiveness of every touchpoint.

It’s also advisable to launch campaigns early: interest rises noticeably at least a week before the event, so early communication helps capture attention and prime the audience. Black Friday 2025 confirms that, in peak season, the winners are those who work systematically with their audience throughout the entire cycle – not just those who cut prices on the day of the sale.