ROS (Return on Sales)

Every company tells a story with its numbers, yet few chapters are as revealing as the one that explains how much profit remains after each sale. Return on Sales steps onto that page like a seasoned editor, cutting through fluff and showing, line by line, how efficiently revenue becomes operating profit. When finance teams whisper “ROS” in boardrooms, they are really asking: are we turning hard-won sales into meaningful, repeatable gains?

What is Return on Sales (ROS)?

Return on Sales is the percentage of net sales that converts into operating income once routine costs are settled. In short, ROS tells you how much profit a firm makes from each dollar it sells. If you sold $100 worth of goods and made $15 in operational profit, that 15% is your Return on Sales. The ratio focuses solely on core activities, eliminating tax anomalies and financial noise, making it straightforward for newcomers to assess a business's profitability.

Investors see return on Sales as both a measure of efficiency and a measure of profitability. It takes operational efficiency, cost management, and price strategy and turns them into one clear percentage. This makes it much simpler to evaluate companies that are in the same market. An increase in ROS is often an indication that a company's business strategy is improving, its supply chain is becoming more efficient, or its market power is expanding.

How to Calculate Return on Sales (ROS)

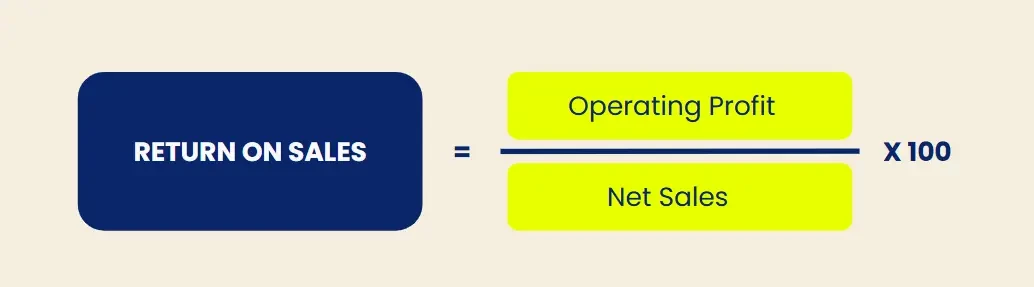

The formula for calculating ROS is as follows:

Where:

- Operating profit (also called operating income) equals net sales minus cost of goods sold (COGS) and operating expenses.

- Net sales represent gross sales less returns, allowances, and discounts.

Step-by-step walkthrough

- Locate net sales on the income statement. Suppose they read $2 500 000.

- Subtract COGS plus operating expenses to uncover operating profit. Assume that equals $300 000.

- Divide $300 000 by $2 500 000 and multiply by 100.

Return on Sales = 0.12 = 12 %

A 12 % ROS tells management the firm captures twelve cents in operating income for every sales dollar. If the previous quarter showed 9 %, the improvement confirms that cost-cutting, smarter pricing, or a richer product mix boosted operational efficiency.

What is a Good Return on Sales Ratio?

Describing a “good” Return on Sales without context is like judging marathon times without knowing the route’s elevation. Still, certain benchmarks keep analysts grounded.

Industry Benchmarks

- Grocery retail: 1–3 % is common, as price wars devour margin.

- Automobile manufacturing: 5–10 % Return on Sales, heavily influenced by steel and semiconductor prices.

- Software-as-a-Service (SaaS): 20–30 % once scale is reached, thanks to low incremental costs.

- Consulting and legal services: 15–25 %, with high reliance on billable-hour utilization.

Tracking your own ROS against the industry average clarifies whether your cost base or pricing strategy needs adjustment.

Company Size and Stage

Startups often tolerate a slim or even negative Return on Sales while land-grabbing for market share. Mature enterprises, especially dividend aristocrats, are expected to defend a solid double-digit ROS year after year or risk shareholder activism.

Economic Cycles

Recessions cut down on discretionary expenditure, which means that sales income drops faster than expenses, which in turn means that Return on Sales normally falls. Companies that are able to stay stable do so by quickly cutting costs or switching to products with higher profit margins.

Why is Return on Sales Important?

Return on Sales is the stethoscope that lets stakeholders hear the heartbeat of a company’s everyday operations.

- Operational efficiency: A climbing ROS reveals that every process, from procurement to fulfillment, is humming.

- Debt repayment capacity: Banks look at the ratio when gauging whether future cash flows can cover principal and interest.

- Reinvestment decisions: Boards use a healthy Return on Sales to justify funding research, expansion, and digital transformation instead of hoarding cash.

- Dividend policy: Stable or rising ROS supports predictable dividend payouts, attracting income-oriented investors.

- Competitive moat: Firms with enduring double-digit ROS typically enjoy cost advantages, strong brands, or patented technology—traits that fend off imitators.

Because the metric leaves out financing structure and taxes, it isolates operational excellence, letting managers focus on levers they truly control.

Factors Affecting Return on Sales

Operating Costs

When energy prices go up or problems with the supply chain make shipping costs go up, the cost of products sold goes up, and Return on Sales goes down. Tight inventory control and renegotiated contracts with suppliers may help with this problem.

Pricing Strategy

Aggressive discounting could boost sales, but if the new price doesn't cover the increased costs, it might affect ROS. On the other side, premium positioning with a strong brand image increases the ratio without lowering sales volume.

Product Mix

A surge in high-margin add-ons or subscription services fattens Return on Sales, while a shift back to low-margin staples compresses it. Monitoring the mix in real time helps managers steer the ratio.

Market Conditions

Commodity industries naturally post lower ROS because products are interchangeable. Companies in niche or high-barrier markets can sustain lofty percentages due to limited competition and inelastic demand.

Scale Economies

As volume rises, fixed costs spread out, leading to a higher Return on Sales, particularly for digital products with negligible marginal cost.

How to Improve Return on Sales

Streamline Operations

Use lean manufacturing, Six Sigma audits, and automation to eliminate waste. Even minor reductions in defect rates or processing time can elevate ROS dramatically.

Optimize Pricing

Use data analytics to figure out how price-sensitive your customers are, and then change pricing in tiny, targeted steps. Putting together items that go well together may make them seem more valuable and increase Return on Sales without making customers feel like they are being ripped off.

Enhance Product Mix

Invest resources in research and development or strategic partnerships to create high-end features. It costs less to upsell current customers than to get new ones, which improves the Return on Sales ratio.

Reduce Cost of Goods Sold

You may change contracts with suppliers, look for other materials, or transfer production closer to vital markets. A little drop in COGS leads to a direct gain in operating profit, which in turn raises ROS.

Boost Customer Retention

Loyal consumers purchase more frequently and don't complain as much when prices go up, which keeps Return on Sales strong even when it costs a lot to get new customers.

Leverage Technology

Deploy ERP and real-time analytics to flag margin erosion early. Data-driven decisions around staffing, inventory, and marketing prevent ROS from drifting downward.

Return on Sales vs. Other Financial Metrics

ROS vs Net Profit Margin

Net Profit Margin includes everything down to taxes and interest, while Return on Sales stops at operating profit. If financing costs rise sharply yet ROS remains steady, management knows core operations are still strong.

ROS vs ROI

Return on Investment measures profit relative to capital invested. A project might flaunt a 25 % ROI but drag down overall Return on Sales if it floods the top line with low-margin revenue. Pairing the two ratios gives a fuller picture.

ROS vs ROE

Return on Equity focuses on earnings generated for shareholders. High leverage can inflate ROE even if operational efficiency is mediocre. Return on Sales adds balance, revealing whether profitability stems from solid operations or financial engineering.

Year-over-Year Return on Sales Trend Example

Consider a mid-size online retailer that reported the following numbers:

| Year | Net Sales | Operating Profit | Return on sales |

| 2023 | $8000000 | $720000 | 9% |

| 2024 | $9500000 | $1330000 | 14% |

In 2023 the company’s ROS stood at 9 %, but by 2024 its Return on Sales jumped to 14 %. Management attributes the surge in ROS to automated warehouse technology that cut pick-and-pack labor costs and an AI-driven pricing engine that nudged average order value higher without dampening demand.

The year-over-year comparison underscores two points. First, even a mature retailer can expand Return on Sales when it minds both cost reduction and price optimization. Second, because ROS isolates operating performance, it offers an early signal that changes inside the shop floor or the marketing funnel are truly working, long before net profit margin or ROE catch up.

When analysts observe ROS go up five percent in a year, they take it cautiously. A jump like this usually means more cash flow, quicker debt repayment, and the ability to reinvest in new ideas, which are all things that every shareholder wants to see.

Final Thoughts

The best managers don’t just chase revenue—they chase revenue that sticks. By reporting how much profit per dollar of sales actually survives the gauntlet of COGS and operating expenses, Return on Sales becomes the flashlight that finds hidden inefficiencies and celebrates operational victories. Run trend analysis quarter after quarter, benchmark against peers, and you’ll feel the power of ROS as a key performance indicator.

Join Our Blog Newsletter!

Stay updated with our latest email marketing tips, product news and case studies.

Terms in the same category

ROMI A/B Testing Customer Journey Marketing Multi-Channel Attribution Repeat Purchase Rate